April Fool’s Day is the day our federal politicians play us for fools — grabbing more of our money and padding their own pockets at the same time.

It happens every year on April 1st.

It’s ingrained in the system; presumably so beat-up taxpayers don’t know they’re taking another hit while inflation is crippling them and food prices have the CEOs of the major grocery chains appearing before a House of Commons committee to explain themselves and their record profits.

It’s sneaky but it works.

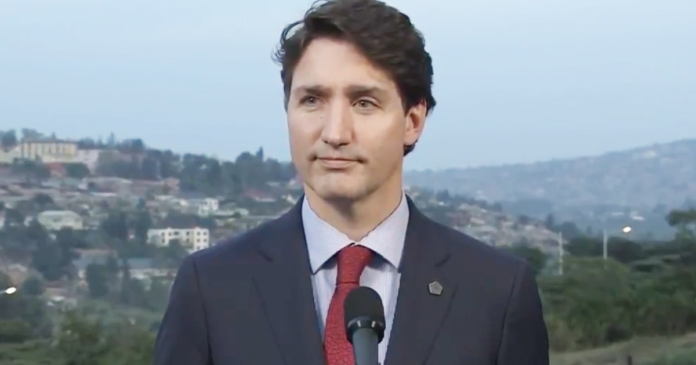

There will be no headline, for example, telling the public that Prime Minister Justin Trudeau will be getting an extra $10,200 on April 1, based on contract data published by the government of Canada. It will just happen.

This, however, will make it the fourth pay raise since the outset of the pandemic, with backbench MPs pocketing an extra $5,100.

A backbencher currently collects a $189,500 salary. Ministers take home $279,900. Trudeau gets $379,000 from taxpayers.

“Do they really think they should take thousands more from their constituents, many of whom are struggling to fill the fridge?” asks Franco Terrazzano, federal director of the Canadian Taxpayer Federation.

Terrazzano is often the bearer of bad news. It’s his job.

On April 1, the federal carbon tax will be jacked up to 14¢ per litre of gas and 12¢ per cubic metre of natural gas.

The Trudeau government claims “families are going to be better off” with its carbon tax and rebates. The government expects us to believe it can raise taxes, skim some off the top to pay for hundreds of new bureaucrats and still make us better off.

As Terrazzano put it, the Parliamentary Budget Officer — one of our watchdogs — has warned against believing such spin.

“The carbon tax will cost the average family between $402 and $847 this year, even after the rebates,” wrote Terrazzano. “ And this will be the fourth time Trudeau has increased his carbon tax since COVID-19 touched down.”

While Ottawa sticks Canadians with higher bills, other countries have provided relief. The Canadian Taxpayers Federation identified 51 national governments that cut taxes during the pandemic and as inflation took off.

That includes more than half of G7 and G20 countries and two-thirds of the countries in the Organization for Economic Co-operation and Development.

Many of our peers were also offering relief at the pumps.

Australia cut its gas tax in half. India cut its gas tax to “keep inflation low, thus helping the poor and middle classes.”

The United Kingdom announced billions in full tax relief. South Korea cut its gas tax by 30%. Germany, the Netherlands, Italy, Israel, Peru, Poland and 25 Indian states also cut their fuel tax.

But not Canada.

“You could be forgiven if all this drives you to drink,” wrote Terrazzano. “But Trudeau will also be reaching further into your wallet every time you pick up a case of Keith’s, a bottle of Pinot or a mickey of rum.

”Canadians already pay about half of the price of beer, 65% of the price of wine and three quarters of the price of spirits in taxes. And in April, the federal excise tax will be going up by another 6.3%.”

Trebles all around, bartender.

First passed in the 2017 budget, the federal escalator tax automatically increases excise taxes on alcohol with the rate of inflation each April 1.

After April’s hike, the federal government’s alcohol excise taxes will have increased by about 18% since the automatic annual increase was introduced.

“This undemocratic tax hike allows MPs to take more money from your wallet every year without having to vote on the increase,” said Terrazzano.

There oughta be a law.